Critical Success Factors for Scaling Startups: Insights from Industry Leaders

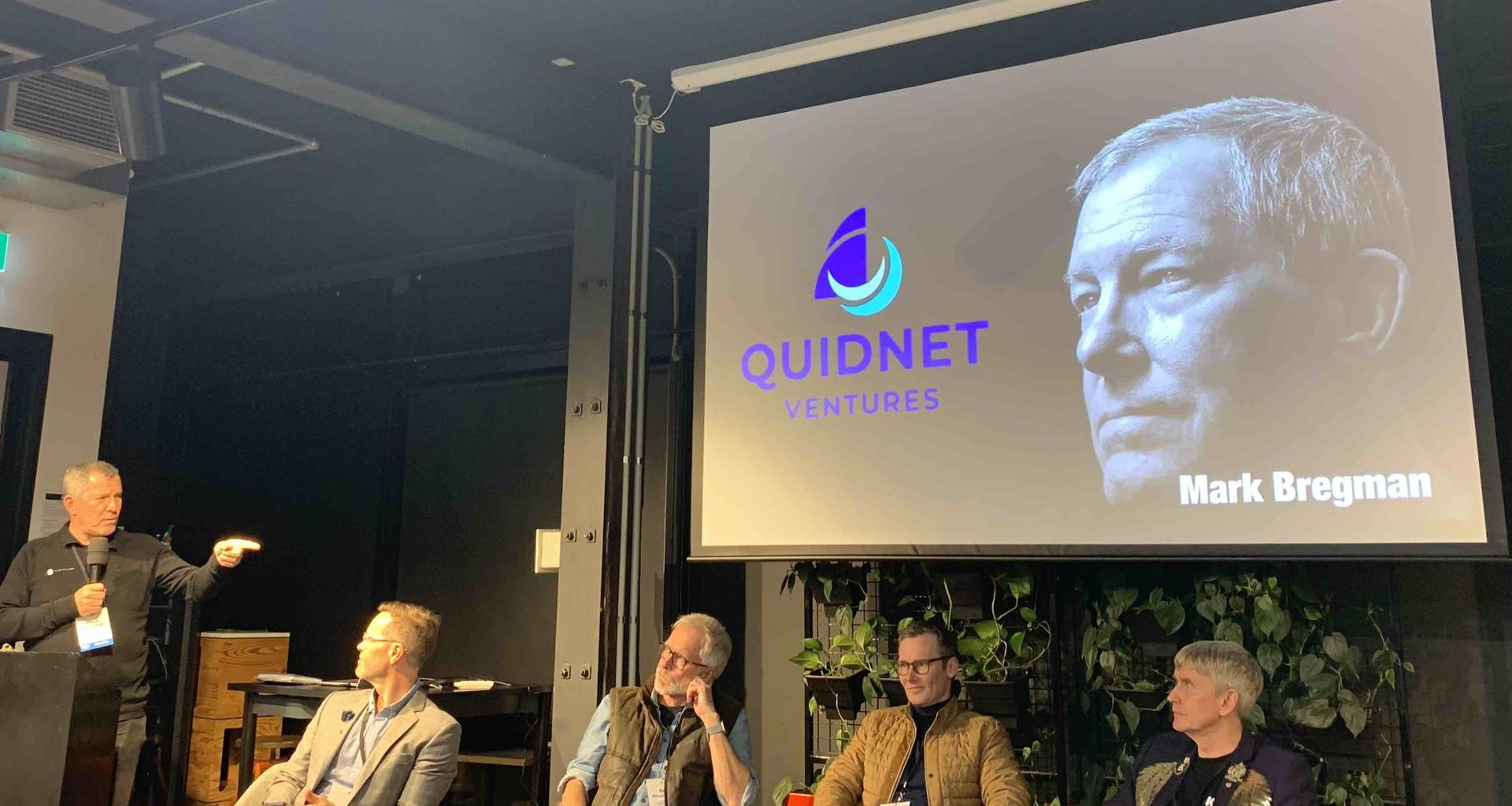

Scaling a startup is a complex and demanding process that requires founders to dream big and think strategically about growth. To tackle this very topic, Tātaki Auckland Unlimited hosted a high-energy panel discussion featuring industry leaders Bob Drummond (CRO, Kami), Mark Bregman (Founder, QuidNet Ventures, and EHF Fellow), Rudi Bublitz (Chief Cat Herder, Flying Kiwi Angels), and Hugh Calveley (Founder and CEO, Moxion). Their diverse experiences sparked a dynamic conversation around the central theme moderated by Josh Cromie, our MC, who showcased his extensive experience as an entrepreneur, investor, and advisor.:

"Where are the gaps in the support available for our startups to scale up?"

The panel dove into the crucial ingredients for successful scaling and discussed the gaps in the startup ecosystem in New Zealand, focusing on what founders need to prioritise and where they often struggle.

The panel highlights some key issues and risks:

- Lack of networking, collaboration, and community-building within New Zealand's startup ecosystem.

- Fear of dilution among founders and early investors.

- Challenges in raising capital, particularly for startups in New Zealand, especially in past years.

- Burnout among startup founders and their teams.

- Inadequate preparation for entrepreneurs facing the challenges of starting and scaling a business.

Key Takeaways from the Panel

1. Early Engagement with Investors and Advisors – Rudi Bublitz

Rudi Bublitz emphasised the value of early engagement with investors. As an angel investor, Bublitz pointed out startup founders often connect with investors long before they are investment-ready. These early conversations allow founders to refine their business models and adjust strategies.

A key aspect Bublitz discussed was the importance of syndication in investment rounds. Syndication ensures that startups have a broad base of investors rather than relying on one group. This approach helps mitigate risk and brings in a wider network of support. Founders should embrace syndication early, as it brings not just money but mentorship and connections from various stakeholders.

2. Building the Right Systems Early – Hugh Calveley

Hugh Calveley’s experience scaling Moxion, which eventually sold to Autodesk, highlighted the importance of establishing the right systems from the outset. “You need systems that suit the company you want to be, not the one you currently are,” said Calveley. Implementing accounting, customer support, and engineering systems early can save significant disruption later.

Calveley also advocated for founder-friendly investment structures and modern platforms like AngelList and Visible VC. These platforms can handle much of the investment infrastructure and documentation, helping streamline complex and resource-intensive processes.

3. Ambition vs. Capital – Mark Bregman

Mark Bregman was direct in his assessment of New Zealand’s startup ecosystem. While he praised Kiwi startups' capital efficiency, he warned against the dangers of "small ambitions." Bregman encouraged founders to be bolder in their vision and seek out international capital, often necessary for scaling globally.

He emphasised that ambition is crucial for attracting investment. While founders must balance ambition with realism, focusing too much on short-term capital constraints can limit a startup's long-term potential. Instead, Bregman urged founders to think globally from day one.

4. Focus and Automation – Bob Drummond

Bob Drummond of Kami reflected on their scaling journey during the COVID-19 pandemic. Kami experienced a surge in demand as schools worldwide moved online, and automation became essential in managing that growth. Samson noted that startups must automate as many processes as possible to free up resources for core tasks and customer interactions.

He also stressed the need for focus. Scaling is about knowing when to say “no.” Drummond shared that Kami decided to focus exclusively on North American schoolteachers, even as other sectors showed interest in their product. “Focus is key. Saying no to certain opportunities is just as important as pursuing the right ones,” Drummond said. This allowed Kami to scale more efficiently by honing in on a specific market.

10 Actionable Steps for Founders Looking to Scale

Start Engaging with Investors Early

- Don’t wait until you need money to contact investors. Start conversations early to build relationships and receive valuable feedback before seeking investment.

Leverage Syndication for Funding

- Engage multiple investors and ensure that your funding rounds are syndicated. This spreads the risk and brings more expertise to help guide your growth.

Implement the Right Systems Early

- From the start, invest in scalable finance, customer support, and operations systems. It’s easier to grow into these systems than to implement them later when you’re stretched thin.

Automate to Manage Growth

- Automate repetitive tasks, especially those related to sales, customer onboarding, and support. This will free up your time to focus on strategic initiatives and growth.

Focus on a Niche Market

- Define a specific target market and focus all your resources on dominating it. Diversifying too early can dilute your efforts and slow down your scaling process.

Embrace Big Ambitions

- Don’t limit yourself to the local market or think small. Embrace the ambition to go global and set your sights on markets that have the potential to grow your company exponentially.

Prepare for the Challenges of Scaling

- Understand that scaling is a gruelling process. Prepare mentally and physically for long hours, and ensure your team is on board with the workload and expectations of rapid growth.

Use Founder-Friendly Investment Structures

- Be mindful of the investment structures you adopt. Explore platforms and legal frameworks that protect your equity and allow flexibility as your company scales.

Network and Collaborate

- Don’t be afraid to connect with other startups and share insights. The competitive mentality is less relevant in New Zealand, and collaboration can open doors and create new opportunities.

Monitor Burnout and Prioritise Wellbeing

- Scaling demands can lead to burnout, both for founders and their teams. To avoid long-term consequences, prioritise mental health, rest, and sustainable work practices.

Start Engaging with Investors Early

- Don’t wait until you need money to contact investors. Start conversations early to build relationships and receive valuable feedback before seeking investment.

Leverage Syndication for Funding

- Engage multiple investors and ensure that your funding rounds are syndicated. This spreads the risk and brings more expertise to help guide your growth.

Implement the Right Systems Early

- From the start, invest in scalable finance, customer support, and operations systems. It’s easier to grow into these systems than to implement them later when you’re stretched thin.

Automate to Manage Growth

- Automate repetitive tasks, especially those related to sales, customer onboarding, and support. This will free up your time to focus on strategic initiatives and growth.

Focus on a Niche Market

- Define a specific target market and focus all your resources on dominating it. Diversifying too early can dilute your efforts and slow down your scaling process.

Embrace Big Ambitions

- Don’t limit yourself to the local market or think small. Embrace the ambition to go global and set your sights on markets that have the potential to grow your company exponentially.

Prepare for the Challenges of Scaling

- Understand that scaling is a gruelling process. Prepare mentally and physically for long hours, and ensure your team is on board with the workload and expectations of rapid growth.

Use Founder-Friendly Investment Structures

- Be mindful of the investment structures you adopt. Explore platforms and legal frameworks that protect your equity and allow flexibility as your company scales.

Network and Collaborate

- Don’t be afraid to connect with other startups and share insights. The competitive mentality is less relevant in New Zealand, and collaboration can open doors and create new opportunities.

Monitor Burnout and Prioritise Wellbeing

Our Closing Thoughts

The panel's insights reinforced that while New Zealand's startup ecosystem offers many opportunities, gaps remain, particularly around ambition, investor engagement, and community collaboration. Founders must focus on building solid foundations—both in terms of systems and relationships—to scale successfully. Automation, focus, and a relentless drive to grow are key factors that can make or break a startup’s journey.

As the night closed with a final round of networking over pizza thanks to Katrina Stewart, the message was clear: New Zealand's startups are poised for global impact. However, the road to scaling is lengthy and requires strategic foresight and tactical execution.