A report recently released by Beca, Fonterra and First Gas outlined the economic and environmental opportunity for Aotearoa.

Natural gas is a key component of New Zealand’s energy system; it provides heating to homes, businesses and powers a large part of our industry. As well as being used for heat, methane is an important feedstock for some of New Zealand’s largest chemical processing operations. Beca, Fonterra and First Gas put together a white paper to discuss the benefits for gas users, waste generators, asset owners, their communities and the environment.

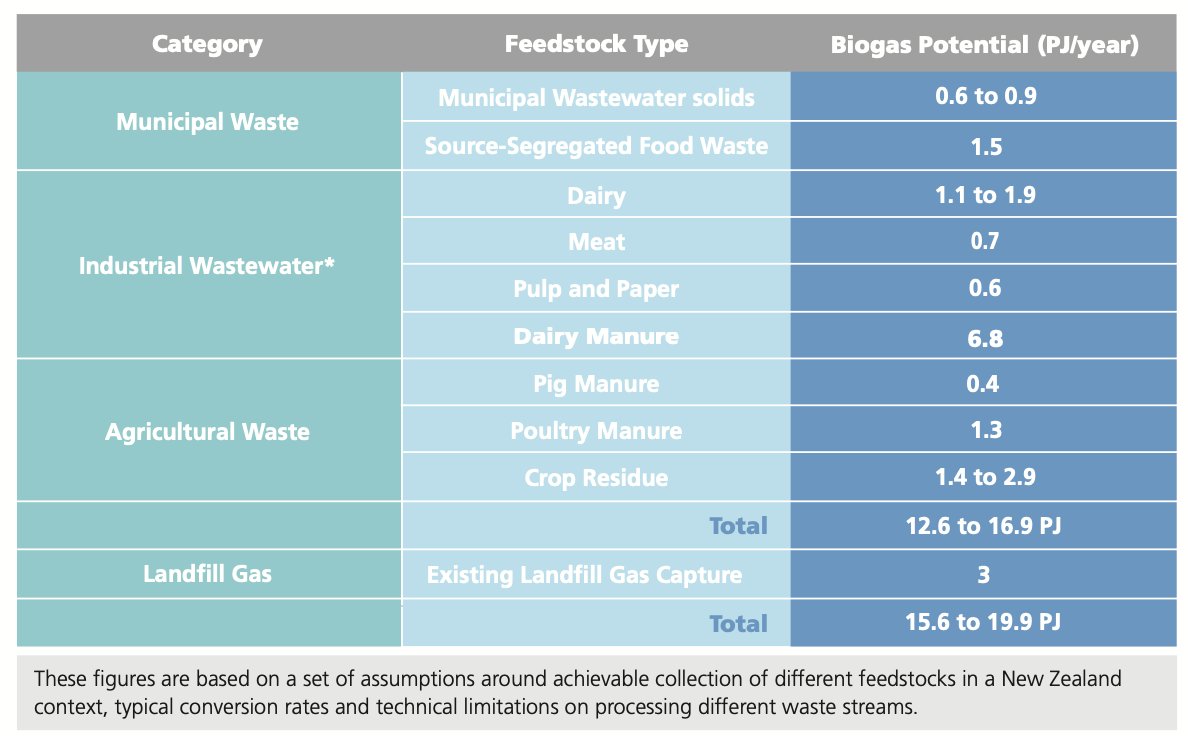

The size of the prize. They indicates that implementation of wide-scale anaerobic digestion in New Zealand could produce between 13 and 17 PJ of biogas energy per year, as well as large quantities of CO2 and digestate as valuable by-products.

Today in New Zealand biogas and biomethane are not part of the main zero-carbon energy conversation. Their analysis shows that digestion plants producing biomethane can become profitable today if supported by charging a gate fee for reception of wastes as well as also selling CO2 and digestate as a by-product. They have reviewed available quantities of feedstocks in New Zealand to understand the maximum achievable biogas generation with existing waste streams. The only key feedstock popular overseas that they did not consider a large contributor to New Zealand’s possible biomethane future is the use of purpose-grown biomass or energy crops for biogas generation, as energy crops are not an established agricultural product in New Zealand and are unlikely to take off in New Zealand given our already highly-productive agricultural sector occupying the majority of available land for energy crops.

The estimates indicate that implementation of wide-scale anaerobic digestion in New Zealand could produce between 13 and 17 PJ of biogas energy per year, as well as large quantities of CO2 and digestate as valuable by-products. This estimate excludes current biogas generation via landfills (around 3 PJ), which may decrease over time as a result of diverting food waste to AD facilities.

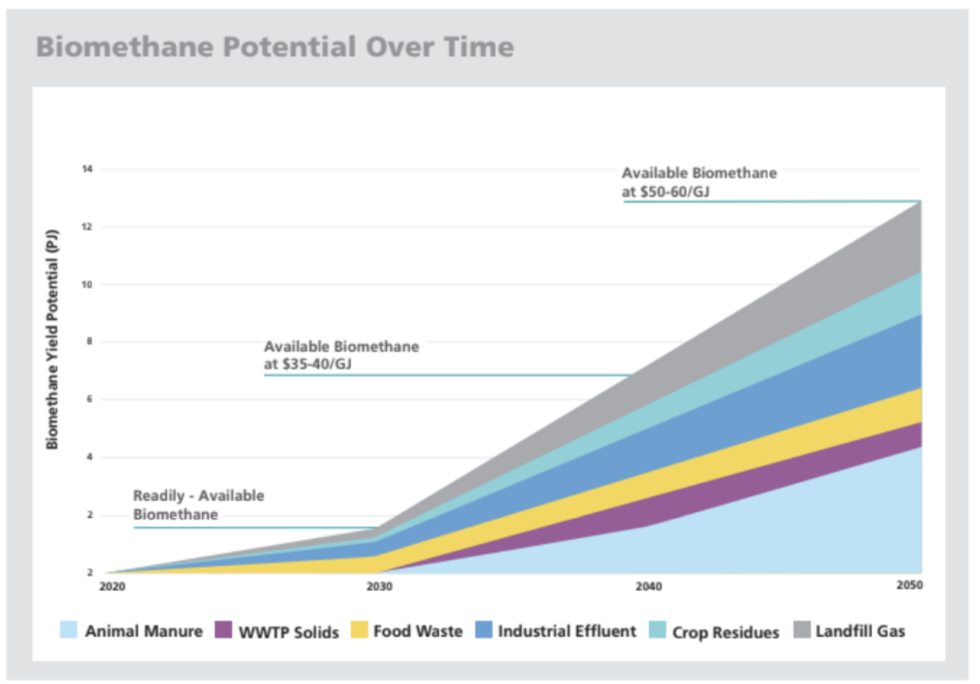

The most significant sources of biogas identified in the analysis were Dairy Manure (5-6.8 PJ), Dairy and Meat Industry Effluents (2.6 PJ) and Source-Segregated Food Waste (1.5 PJ). The report estimated that a biomethane sale price similar to current natural gas prices could allow up to 1.6 PJ could be made using readily available feedstocks A further 5.6 PJ would become available in coming decades as natural gas prices increase above $35 /GJ, driven by Emissions Trading Scheme (ETS) price rises and natural gas scarcity.

Out to 2050, 13 PJ could become available as hard-to-utilise feedstocks like animal manure and crop residue, which don’t stack up economically today, become viable at biomethane prices of $50-60 /GJ. These high prices help to provide revenue for new plants that cannot charge a gate fee or maximise their digestate value.